A Charitable Gift Annuity (CGA) is a simple contract between you and the Entertainment Community Fund.

HOW IT WORKS in simple terms

- You transfer cash or securities to the Entertainment Community Fund.

- You receive an income tax deduction and may save capital gains tax.

the Fund pays a fixed amount each year to you or another person you name for life. Typically, a portion of these payments is tax-free. When the gift annuity ends, its remaining principle passes to the Fund. (For more in-depth information on how a CGA works, see below.)

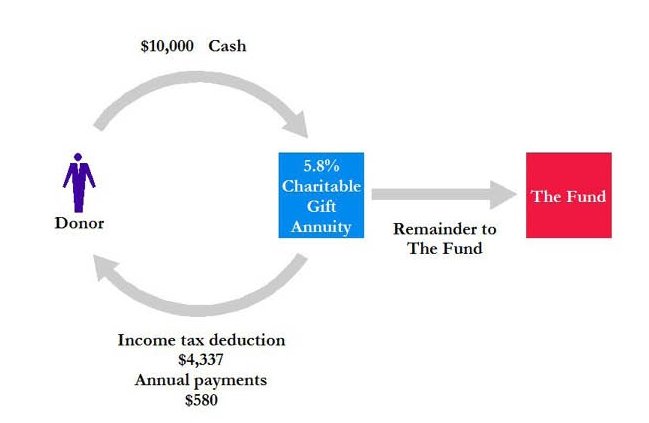

You irrevocably transfer $10,000 in cash (or appreciated securities* of similar value) to the Entertainment Community Fund in exchange for a $580 annuity for an annuitant, age 72.

Some copy and above diagram courtesy of PG Calc Inc.

BENEFITS INCLUDE:

- You will qualify for a federal income tax deduction of approximately $4,337. Your deduction may vary modestly depending on the timing of your gift.

- The annuitant(s) you name will receive fixed annual payments for life, backed by the general resources of the Entertainment Community Fund.

- Your designated annuitant will receive fixed payments in quarterly installments totaling $580 each year for life. In addition, $390 of each year’s payments will be tax-free for the first 14.5 years.

* If you fund the annuity with a long-term appreciated asset (one you have held for more than one year), you will incur tax on only part of the gain. If you name yourself as an annuitant, this tax will be spread out over many years. - Your estate may enjoy reduced probate costs and estate taxes.

- You will provide generous support to the Entertainment Community Fund.

HOW IT WORKS (more in-depth)

In exchange for your irrevocable gift of cash or securities (minimum value $10,000), the Entertainment Community Fund agrees to pay one or two annuitants you name a fixed sum each year for life. The payments are backed by the general resources of the Entertainment Community Fund.

The older your designated annuitants are at the time of the gift, the greater the fixed payments the Entertainment Community Fund can agree to pay. (To qualify, the designated annuitant must be at least 68 years of age at the time of first payment.)

In most cases, part of each payment is tax-free, increasing each payment’s after-tax value. If you give appreciated property you will pay capital gains tax on only part of the appreciation. In addition, if you name yourself as the first or only annuitant the capital gains tax will be spread out over many years rather than be all due in the year of your gift.

For information on rates and an illustration on how a Charitable Gift Annuity would look for you, please get in touch with:

Jay Haddad

Manager of Individual Giving

917.281.5928